Menu

Close

- Products & Services

- E-commerce Solutions

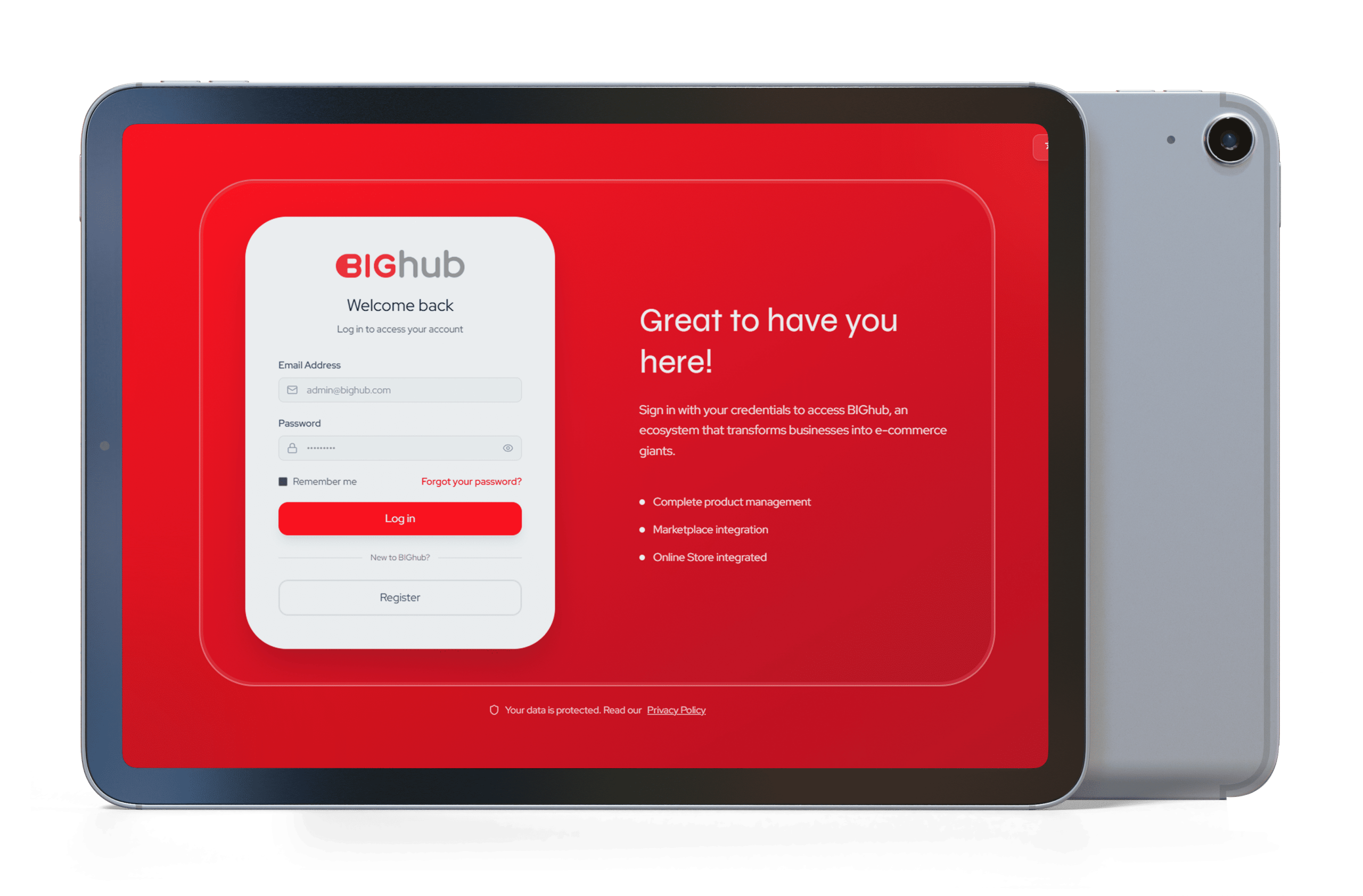

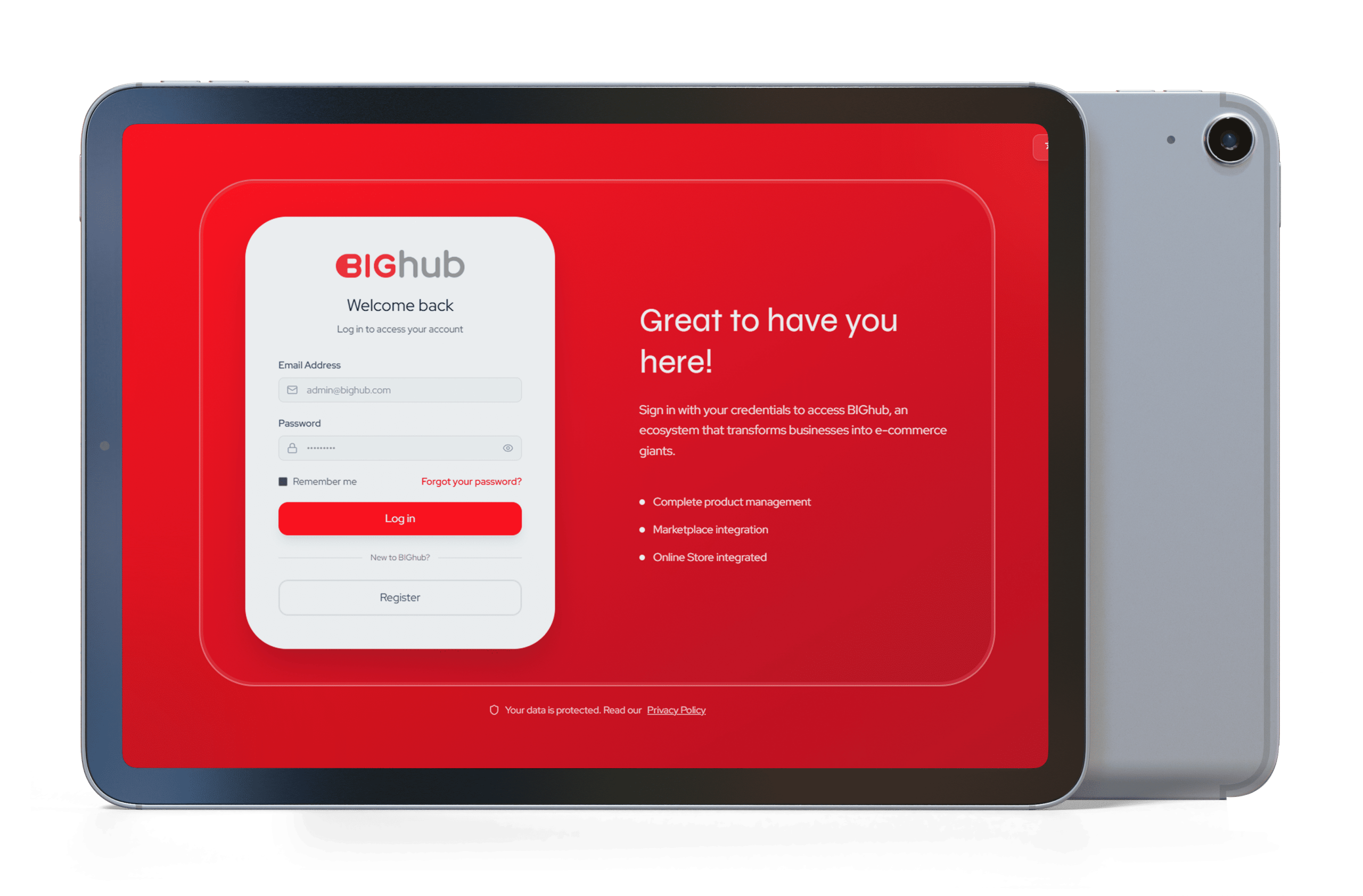

E-commerce Integration

BIGhub: european marketplace growth platform – E-commerce Integration

- Plans & Pricing

- More

- Products & Services

- E-commerce Solutions

E-commerce Integration

BIGhub: european marketplace growth platform – E-commerce Integration

- Plans & Pricing

- More

Menu

Close

- Products & Services

- E-commerce Solutions

E-commerce Integration

BIGhub: european marketplace growth platform – E-commerce Integration

- Plans & Pricing

- More

- Products & Services

- E-commerce Solutions

E-commerce Integration

BIGhub: european marketplace growth platform – E-commerce Integration

- Plans & Pricing

- More